ULIPs are fast gaining popularity, with investors seeking to take dual advantage of insurance and investment in a single plan. However, it is important to know how it works before you pick one. Keep reading to know more.

Content:

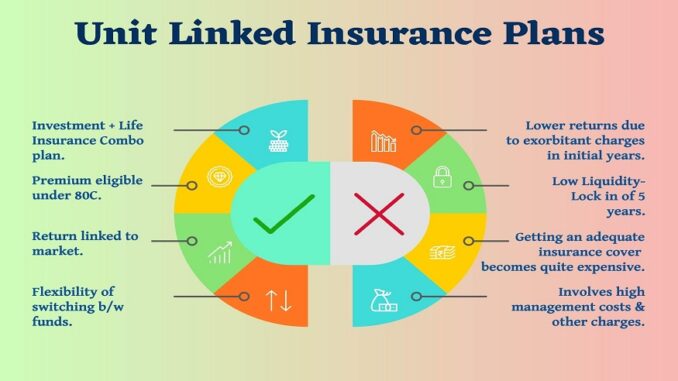

A Unit Linked Insurance Plan, popularly known as ULIP, is an attractive investment option along with the benefit of life insurance. ULIP can enable wealth creation with the help of market-linked returns and systematic investments. ULIP investors can grow their wealth over long years and avail the benefit of life cover in case of a casualty.

How ULIPs Work in India

ULIP came to India in the year 1971. Since the year 2010, the Insurance Regulatory and Development Authority of India (IRDAI) manages and regulates ULIPs. ULIPs allow for investment in the stock market along with a life insurance cover. Let us understand their broad working through the following points –

Payments

- Before investing in the capital market via ULIPs, decide the premium amount, payment option, life cover, and policy term in sync with expected savings and financial protection.

- Decide if the payment will be a lump sum, upfront, or recurring (monthly/half-yearly/yearly).

Investments

- One part of the premium goes into life insurance cover, and the other part goes into investing (equity/debt/hybrid), as per the preference.

- Equity funds majorly invest in stocks.

- Debt funds diverge capital into government securities, bonds, and other low-risk investments.

- Hybrid funds balance high-risk, high-return potential equities with stable debt funds.

- The funds are invested for a long time to generate returns and grow capital.

- In a situation of unexpected casualty during the policy span, the nominee will receive the sum assured.

Lock-in Period

- There is a provision of a lock-in period to gauge the policy. If found unsuitable, then it can be cancelled.

Charges

- ULIP policyholders have to pay certain charges, such as administration charges, switching charges, fund management costs, mortality charges, and partial withdrawal charges.

Purpose

- For ULIP purchased for retirement purpose, the premium is paid for full employment tenure.

- For meeting the purpose of child education, regular payouts are received. Key educational milestones get fulfilled even if the policyholder dies.

- If ULIP is for health benefits, then a sum is assured for meeting medical emergencies.

Case Studies

Let us consider two different cases to understand the working and applicability of ULIP plans –

Case 1

Ms Asha is a young lady in her mid-20s, a management graduate with a fresh job in hand. Her investment goal is life insurance cover along with wealth building.

ULIP Applicability –

Ms Asha invests in ULIP because of longer investment tenure and deep risk cushioning. She can also switch from higher-to-moderate-to-lower equity bandwidth for a balanced portfolio.

Case 2

Mr Bharat is a freelancer in his late 30s. He is a single earning person with his wife and 5-year-old daughter in his family. His investment goal is to preserve wealth and to be able to withdraw funds for different goals, like the education of his daughter, home renovation, earning retirement, etc.

ULIP Applicability –

A ULIP policy will help Mr Bharat plan for the higher education of his daughter without compelling him to dip into his other savings. This plan is also perfect for systematic withdrawal for regular expenses. The remaining funds can go into his retirement corpus.

Invest in a ULIP policy for its unique financial applicability and derive many benefits in the form of wealth growth, tax rebates, exemptions, etc. for developing a multifaceted portfolio.

Leave a Reply

You must be logged in to post a comment.