Before I begin with the directions and tips that you simply area unit purported to follow, let ME tell you that any significant vehicle that weighs over fifty,000 pounds and has run over five,000 miles, then you’re purported to file kind 2290 on-line. Yes, you browse it properly. you have got to try to to the web filing that has become necessary as per the foundations of the US Government. you’ll be able to fill {the on-line|the web|the net} kind through tax 2290 online. you’ll be able to additionally take the help of whereas filing the web kind 2290. client care service is often there.

Form 2290 on-line directions

You can use the shape 2290 on-line for the subsequent

Figure and pay the tax due on main road automobiles used throughout the amount with a assessable gross weight of fifty five,000 pounds or more;

Figure and pay the tax due on a vehicle that you completed the suspension statement on another kind 2290 if that vehicle later exceeded the mileage use limit throughout the period;

Figure and pay the tax due if, throughout the amount, the assessable gross weight of a vehicle will increase and therefore the vehicle falls into a brand new category;

Claim suspension from the tax once a vehicle is anticipated to be used five,000 miles or less (7,500 miles or less for agricultural vehicles) throughout the period;

Claim a credit for tax paid on vehicles that were destroyed, stolen, sold, or used 5,000 miles or less (7,500 miles or less for agricultural vehicles);

Report acquisition of a second hand assessable vehicle that the tax has been suspended;

Figure and pay the tax due on a second hand assessable vehicle nonheritable and used throughout the amount.

So, you have got to follow these directions and tips before filing kind 2290 tax on-line.

Important Reminders

Now, if you’re having confusion concerning paying the significant main road vehicle use tax, therefore let ME tell you that Associate in Nursing interactive interview will assist you determine if you would like to pay main road use tax on a main road motorized vehicle. Here area unit a number of the necessary reminders –

File kind 2290 kind for any assessable vehicles initial used on a public main road throughout or once Gregorian calendar month 2020 by the Day of Judgment of the month following the month of initial use. See once to IRS schedule one copy or File kind 2290 for a lot of details.

Everyone should complete the primary and second pages of kind 2290 at the side of each pages of Schedule one. you merely got to complete the “Consent to revealing of Tax Information” and “Form 2290-V, Payment Voucher” pages once applicable.

You must have a longtime leader number (EIN) to file the IRS form 2290. Apply on-line currently if you don’t have already got Associate in Nursing EIN; it’ll take North American country regarding four weeks to determine your new EIN in our systems.

If you need in-person IRS facilitate, you need to schedule a rendezvous with Associate in Nursing IRS payer help Center by business 844-545-5640. See Contact Your native IRS workplace for info.

Read more: How Tax Relief Services Work

Final Words

Now, that you simply recognize what all is required within the schedule one of IRS kind 2290 on-line filing, you’ll be able to file the shape pretty simply.

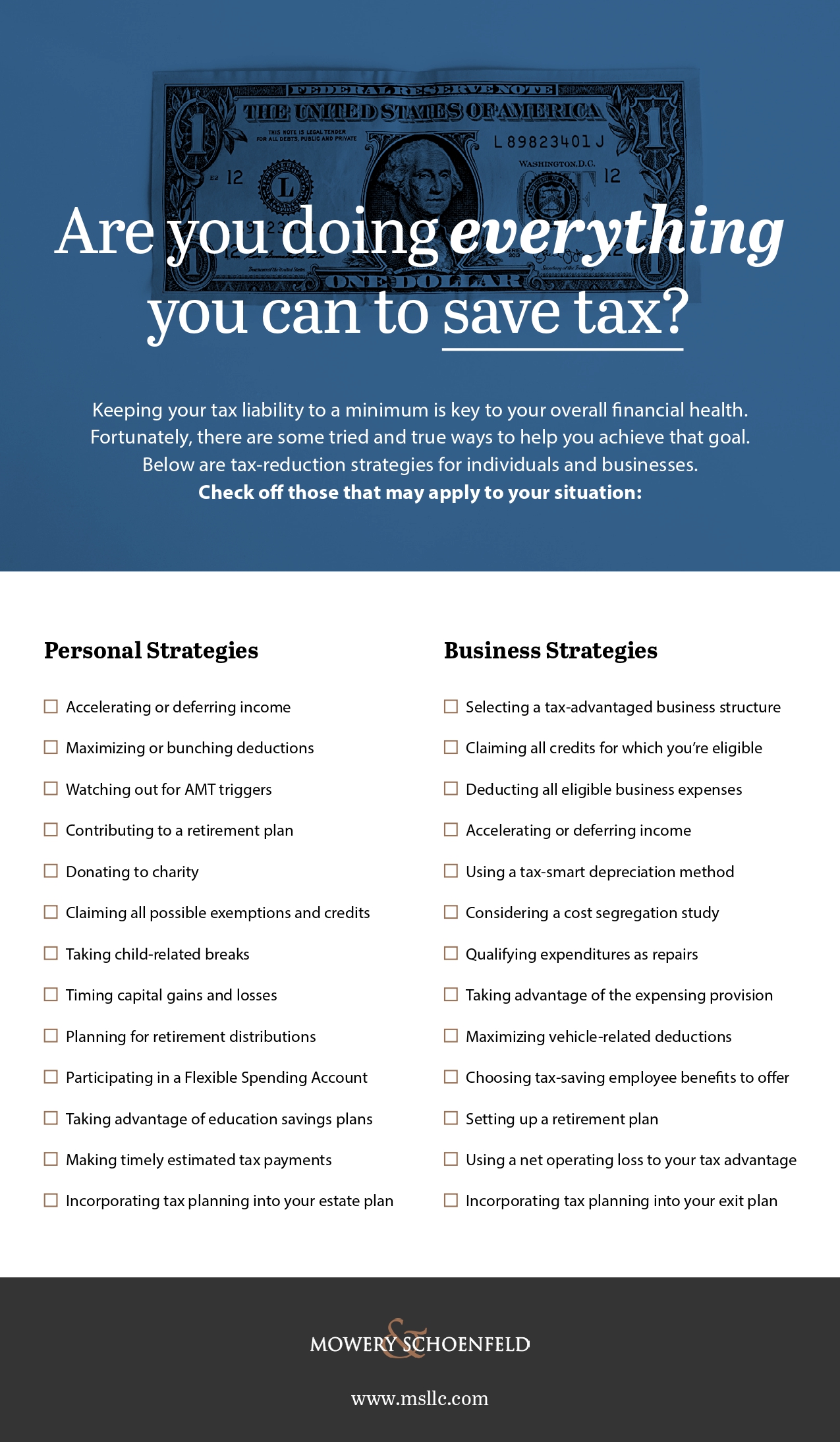

Now that you know the basics of doing your taxes, check out the infographic below for tips to save as much as you can on tax day!

Infographic provided by Mowery & Schoenfeld, LLC., an individual tax services provider.

Leave a Reply

You must be logged in to post a comment.